Dark Economic Clouds

An April 24 report from CBO:

CBO has developed preliminary projections of key economic variables through the end of calendar year 2021, based on information about the economy that was available through yesterday and including the effects of an economic boost from legislation recently enacted in response to the pandemic. In addition, CBO has developed a preliminary assessment of federal budget deficits and debt for fiscal years 2020 and 2021. CBO will provide a comprehensive analysis of that legislation and updated baseline budget projections later this year.

In the second quarter of 2020, the economy will experience a sharp contraction, and CBO’s current economic projections include the following:

- Inflation-adjusted gross domestic product (real GDP) is expected to decline by about 12 percent during the second quarter, equivalent to a decline at an annual rate of 40 percent for that quarter.

- The unemployment rate is expected to average close to 14 percent during the second quarter.

- Interest rates on 3-month Treasury bills and 10-year Treasury notes are expected to average 0.1 percent and 0.6 percent, respectively, during that quarter.

- For fiscal year 2020, CBO's early look at the fiscal outlook shows the following:

- The federal budget deficit is projected to be $3.7 trillion.

- Federal debt held by the public is projected to be 101 percent of GDP by the end of the fiscal year.

An April 22 report from the Committee for a Responsible Federal Budget:

Today, the Social Security Trustees released their annual report, showing that Social Security faces a precarious and worsening financial situation – even before accounting for the current public health crisis. The novel coronavirus (COVID-19) pandemic is likely to further worsen the program’s finances, mainly by depressing payroll tax revenue.

...

Before incorporating the adverse effects of the COVID-19 crisis, the Social Security Trustees project the program is only 15 years from insolvency.

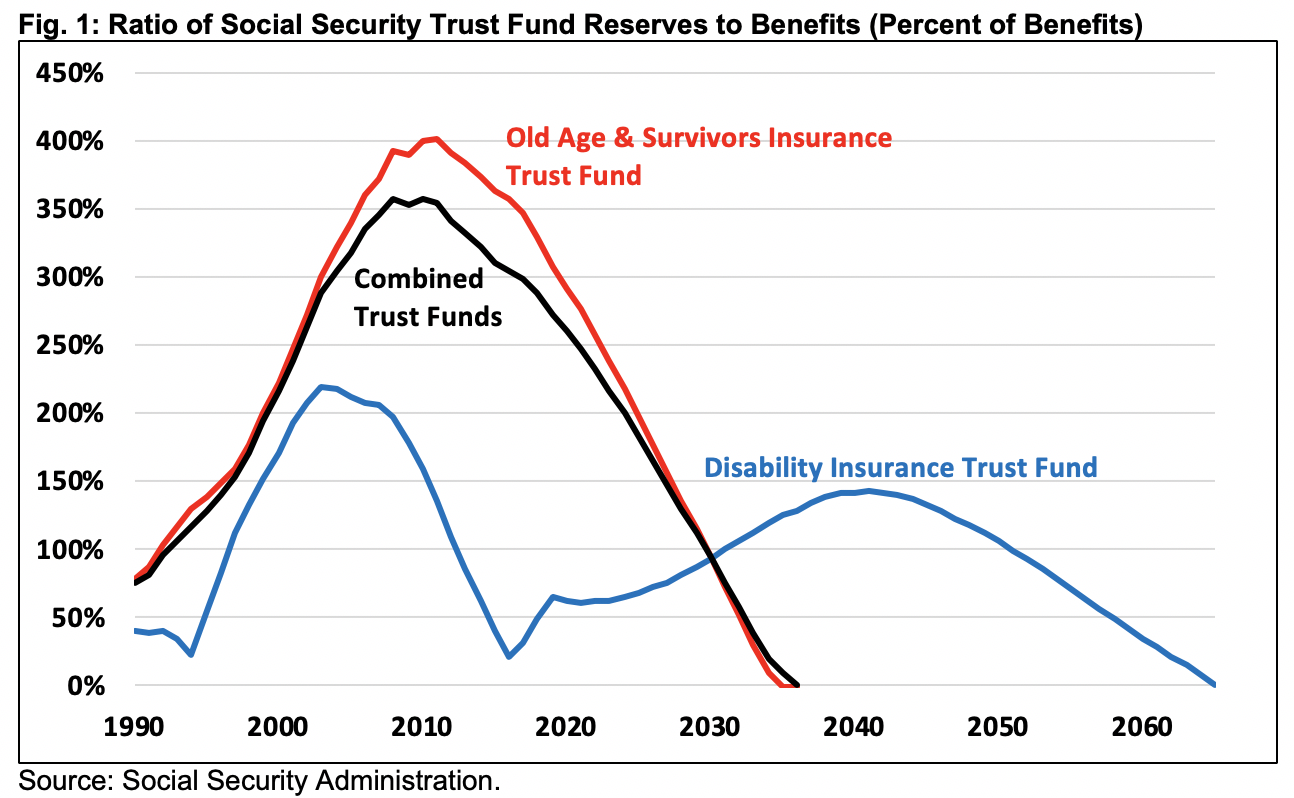

They project the Old-Age & Survivors Insurance (OASI) trust fund will deplete its reserves by 2034, while the Social Security Disability Insurance (SSDI) trust fund is projected to be exhausted by 2065. On a theoretical combined basis – assuming revenue is reallocated between the funds in the years between OASI and SSDI insolvency – Social Security will become insolvent by 2035.

Upon insolvency, all beneficiaries regardless of age, income, or need will face a 21 percent across-the-board benefit cut, which will grow to 27 percent by the end of the projection window.

The year 2035 is only 15 years away. That means the trust funds will run out of reserves when today’s 52-year-olds reach the normal retirement age and today’s youngest retirees turn 77. For perspective, the average new retiree will live to age 85, meaning Social Security cannot guarantee full benefits for many current retirees, let alone future beneficiaries (See How Old You Will Be When Social Security’s Funds Run Out).

In reality, the situation is far worse. The current economic crisis will dramatically reduce payroll tax revenue this year and beyond; it is also likely to increase disability applications. As a result, Social Security Disability Insurance is likely to be insolvent decades earlier than the Trustees project – perhaps in the 2020s – and the old age program several years earlier than projected.